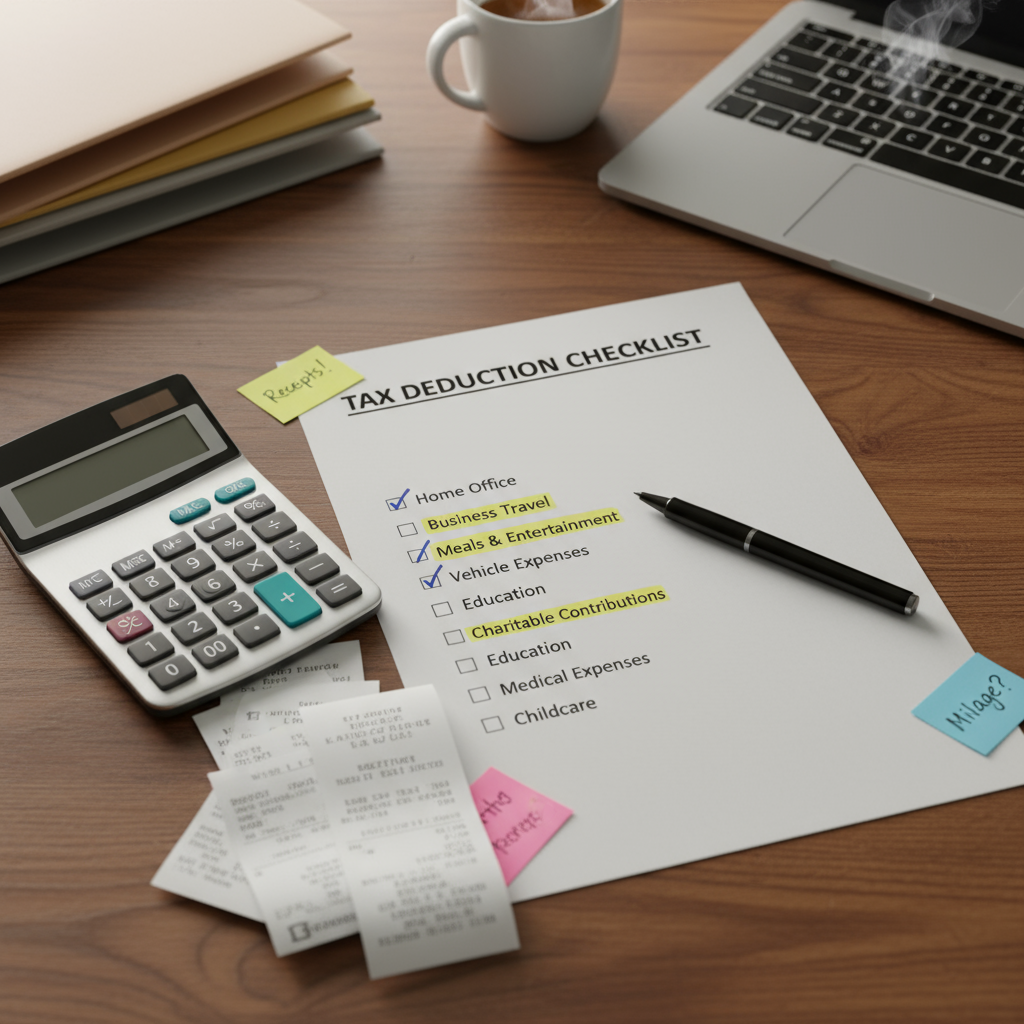

🧾💡 Tax Deduction Checklist

A practical, ready-to-use checklist designed to help small business owners, freelancers, and individuals identify and track eligible tax deductions. The Tax Deduction Checklist provides a structured approach to ensure you maximize savings while staying compliant with tax regulations.

Perfect for entrepreneurs, freelancers, and anyone managing personal or business taxes who wants to simplify preparation and reduce the risk of missed deductions.

📦 What’s Included

• Categories for common deductions: business expenses, home office, travel, equipment, and more

• Sections for documentation, receipts, and verification

• Tips for maximizing eligible deductions and avoiding errors

• Instructions for integration with accounting or tax software

• Bonus: annual tax planning tips and reminders

🌟 Key Benefits

• Maximize tax savings by identifying all eligible deductions

• Reduce errors and missing documentation during tax season

• Organize expenses efficiently for easy reporting

• Save time with a structured, ready-to-use format

• Suitable for freelancers, small business owners, and self-employed professionals

👥 Perfect For

• Freelancers, consultants, and entrepreneurs

• Small business owners and startups

• Individuals managing personal tax deductions

• Accountants and bookkeepers assisting clients

📁 Format & Delivery

• Instant digital download (Excel, Google Sheets + PDF checklist)

• Fully editable and reusable for each tax year

• Ready to implement immediately for organized tax preparation

Reviews

There are no reviews yet.